CRISIL has enhanced the rated amount while retaining 'AAA/Stable' on the debt instruments and bank facilities of Larsen & Toubro (L&T). The rated amount enhanced to Rs 630 billion from Rs 610 billion for certificate of deposits. CRISIL's ratings continue to reflect L&T's dominant position in the engineering and construction (E&C) market in India, the company's diversified revenue profile, and strong financial flexibility.

CRISIL has enhanced the rated amount while retaining 'AAA/Stable' on the debt instruments and bank facilities of Larsen & Toubro (L&T). The rated amount enhanced to Rs 630 billion from Rs 610 billion for certificate of deposits. CRISIL's ratings continue to reflect L&T's dominant position in the engineering and construction (E&C) market in India, the company's diversified revenue profile, and strong financial flexibility.

Commenting on the rationale, the rating agency said, ''The ratings also factor in L&T's increasing exposure to risks related to large infrastructure developmental projects being undertaken by various special purpose vehicles (SPVs), primarily through the subsidiaries, L&T Infrastructure Development Projects (L&T IDPL), L&T Power Development (L&T PDL) and L&T Realty.''

Commenting on the rationale, the rating agency said, ''The ratings also factor in L&T's increasing exposure to risks related to large infrastructure developmental projects being undertaken by various special purpose vehicles (SPVs), primarily through the subsidiaries, L&T Infrastructure Development Projects (L&T IDPL), L&T Power Development (L&T PDL) and L&T Realty.''

CRISIL believes that L&T will maintain its leadership position in the E&C segment in India, and that the company is positioned to benefit from the large infrastructure spending in the country, over the medium term. Moreover, L&T is likely to maintain its healthy cash accruals despite the challenging market conditions for the E&C segment, and will continue with its diversified project-mix strategy to mitigate concentration risks and profitability pressures. The outlook may be revised to 'Negative' if L&T's exposure to development projects weakens its capital structure.

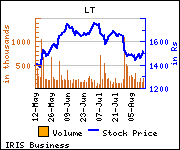

Shares of the company gained Rs 16.75, or 1.11%, to trade at Rs 1,532.50. The total volume of shares traded was 241,905 at the BSE (3.21 p.m., Tuesday).